This post will explain the applicable statute of limitations on the collection of debt under Maryland law. Throughout this post, we will refer to the person who borrowed money as the “debtor,” and the lender of that money will be the “creditor.” The statute of limitations is basically like a legal time limit or deadline. If the statute of limitations has expired, the creditor no longer has the legal right to enforce the debt against you in court.

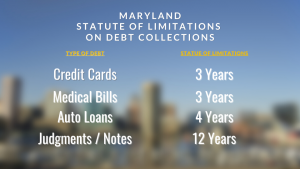

The applicable statute of limitations in Maryland will depend on the type of debt involved.

Credit Card Debt: 3-Year Statute of Limitations

Under Maryland law, the statute of limitation on credit card debt collection is 3 years. The creditor must file a lawsuit against you in court to enforce the debt within 3 years, or they will lose the legal right to enforce that debt against you in court. For credit cards, the 3-year period begins to run on the date the debt is “incurred.” Md. Code Ann., Cts. & Jud. Proc. § 5-101.

For a revolving line of credit, like a credit card, debt is treated as incurred when it first becomes past due. This is typically when you first fail to make your minimum payment for credit cards. From that point forward, the credit card company must file a lawsuit against you in court within 3 years.

It used to be that the 3-year statute of limitations would restart if the debtor made a payment to the creditor even after the deadline had long passed. To take advantage of this loophole, creditors often asked debtors to make small payments, tricking them into reaffirming the debt and restarting the 3-year period.

Maryland counteracted this “problem” in 2016, enacting a new statute to protect debtors. Maryland Courts & Judicial Article Section 5-1202(a) prohibits a creditor from initiating a consumer debt collection action after deadline to bring a lawsuit had passed.

Section 5-1202(b) clarifies that any payment made by the debtor after the statute of limitations has expired will not revive or extend the deadline.

Medical Debt: 3 Year Statute of Limitations

Medical debt refers to unpaid bills from a doctor, hospital, or other healthcare providers for treatment or services not covered by insurance. Medical debt is subject to the general 3-year statute of limitations in Maryland. This means the doctor or healthcare provider must bring legal action against you within 3-years of the date the debt is incurred. Medical debts are “incurred” on the date of the medical treatment or service or rendered. Md. Code Ann., Cts. & Jud. Proc. § 5-101

Medical debt refers to unpaid bills from a doctor, hospital, or other healthcare providers for treatment or services not covered by insurance. Medical debt is subject to the general 3-year statute of limitations in Maryland. This means the doctor or healthcare provider must bring legal action against you within 3-years of the date the debt is incurred. Medical debts are “incurred” on the date of the medical treatment or service or rendered. Md. Code Ann., Cts. & Jud. Proc. § 5-101

Car Loans: 4-Year Statute of Limitations

The statute of limitations for debt related to a car loan in Maryland is 4 years. Car loans are secured by a lien on your car, giving the creditor the right to repossess the vehicle if you default. When you default on a car loan, the creditor will repossess your car and sell it off. The proceeds of the repossession and sale of the vehicle are applied to your outstanding debt. In most cases, however, this is insufficient to completely pay off your loan balance. If the creditor wants to get a judgment against you for the remaining deficiency balance, they have 4 years to file suit. Md. Code Ann., Comm. Law § 2-725.

Mortgage Promissory Notes: 12-Year Statute of Limitations

When you get a mortgage loan to buy a house in Maryland, you give the lender a Deed of Trust, which gives them the right to foreclose if you default. You also give the lender a separate promissory note that obligates you to repay all the money they lent. If you default on your mortgage, the lender can foreclose on the house and apply the foreclosure sale proceeds to the amount you owe.

Usually, the foreclosure proceeds are insufficient to cover your underlying loan’s balance. The mortgage lender can get a judgment against you for the remaining deficiency balance on the promissory note. Actions to enforce a deficiency balance on a promissory mortgage note are subject to a 12-year statute of limitations. Md. Code Ann., Cts. & Jud. Proc. § 5-102(a)(1).

Judgments Valid and Enforceable for 12 Years

If a creditor takes you to court and gets a money judgment against you for an unpaid debt, that judgment is valid and legally enforceable for 12 years from the date the judgment is entered. The judgment can be renewed at any time, which extends it for another 12 years.

Expiration of Statute of Limitations Does Not Prevent Negative Credit Reporting

If the statute of limitations expires on a debt, the creditor is prohibited from legally going to court and getting a money judgment against you. So you can’t be sued. However, the expiration of the statute of limitations does not prohibit the creditor from negatively reporting the debt and your default to the credit bureaus. Even if the statute of limitations has expired, an outstanding balance on debt can still be reported to credit agencies for years afterward.

- Maryland sex abuse statute of limitations may be changing

Maryland Lawyer Blog

Maryland Lawyer Blog