In Mayor of Baltimore City v. Prime Realty Assocs., L.L.C., the Court of Appeals of Maryland addressed the constitutional issue of notice and the opportunity to be heard.

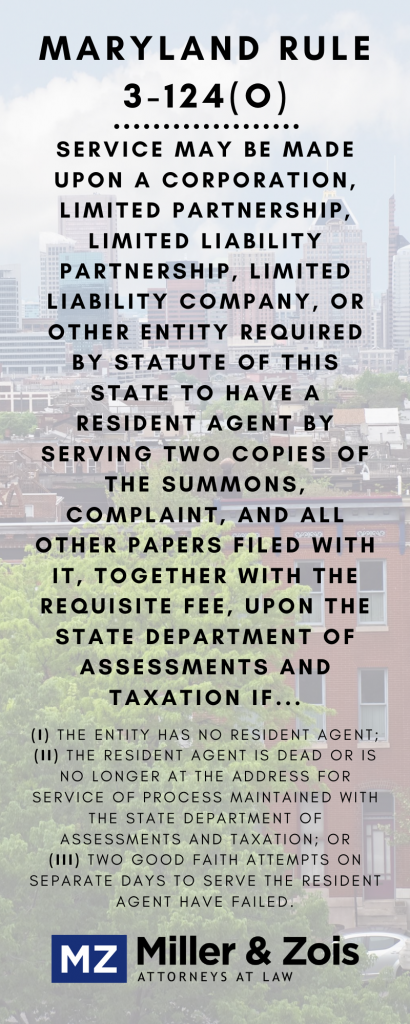

Let me give you a quick summary and then we will dive deeper into it. The court addressed notice as it pertains to whether or not the method of substituted service upon the State Department of Assessments and Taxation (SDAT) prescribed by Maryland Rule 3-124(o) satisfies a litigant’s due process rights. The court held that Prime Realty’s failure to update its resident agent’s address with the SDAT didn’t invalidate the City’s attempts of service or the City’s use of substituted service upon the SDAT, as prescribed in Rule 3-124(o).

Accordingly, the court found that Maryland Rule 3- 124(o) provides due process of law, and the circuit court erred in invalidating the order ratifying the sale of Prime Realty’s vacant building.

Factual Background

A plaintiff in Maryland is permitted under limited conditions to substitute service of process on the SDAT, rather than serving the business. Proper service is typically provided to a business by personally serving its resident agent. The substituted service rule provides a backup provision when regular service has been unsuccessful.

In this case, the Mayor and City Council of Baltimore initiated a receivership action against Prime Realty Associates, L.L.C., when property owned by Prime Realty became uninhabitable. The City attempted on several occasions to serve Prime Realty’s resident agent at the address on file with the SDAT.

After those attempts proved unsuccessful, the City gave substitute service to the SDAT, under Maryland Rule 3-124(o). Prime Realty didn’t participate in the receivership action until after the court-appointed a receiver, sold the property, and the sale was ratified by the District Court of Maryland. After ratification of the sale, Prime Realty moved to vacate, contending that the City did not adequately serve them. Prime Realty claimed that this violated their due process rights.

Receivership is a code enforcement tool enacted by the City to allow them to lessen a public nuisance that is created by vacant and problematic properties. To begin the receivership process, the Baltimore City Commissioner of Housing and Community Development must first determine that a building is vacant. If found vacant, the Commissioner may order the property to be rehabilitated by the owner.

If a property owner fails to comply, the Commissioner may appoint a receiver to rehabilitate it or sell the building to a buyer that will. For this to be successful the property owner must’ve been provided notice. Once the property has been sold, the original property owner has thirty days to file exceptions to the sale.

This particular dispute arose out of a receivership action for a residential building owned by Prime Realty. After tenants moved out of the building it remained vacant and, its condition deteriorated. The City then declared the building unfit for human habitation.

The City posted the violation notice on the property and mailed a copy of the notice to a post office box address that Prime Realty used. After three years the building remained unaltered and still uninhabitable. The City then decided to move forward with the receivership action. The City filed notice to Prime Realty’s business address on file with the SDAT. However, the resident agent, Mr. Belen had relocated in 2010 and failed to correct the new address with the SDAT. The City continued to attempt to serve Mr. Belen personally, and twice more with the residence provided by the SDAT, all were unsuccessful. Consequently, the City moved forward by substituting service upon the SDAT, under Maryland Rule 3-124(o), and proceeded to sell the property.

Procedural History

Prime Realty filed a verified motion to vacate, revise, and strike judgment contending that the City did not adequately serve them, therefore violating its due process rights. Four days later, the District Court issued an order denying Prime Realty’s Motion to vacate. Subsequently, the District Court ratified the final accounting and closed the case.

Prime Realty filed a timely notice of appeal claiming that the City’s use of substituted service to the SDAT under Maryland Rule 3-124(o) violated their due process rights. The Circuit Court granted Prime Realty’s motion to vacate, citing that the City knew the homeowner’s whereabouts beyond what the SDAT had in their records. The City then petitioned the Court of Appeals of Maryland, who granted a writ of certiorari.

Reasoning and Holding

The court was presented with two issues in the case. First, does Maryland Rule 3-124(o) provide for full due process of law, and did the court commit an error by invalidating the sale of Prime Realty’s property when Prime Realty’s lack of notice was a result of its failure to provide a current address?

The Court of Appeals of Maryland begins by discussing the legislative history of the Maryland Rule. The court cites Rule 3-124(o)’s deep-rooted foundation in Maryland’s legal history. The court notes that the rule was drafted to promote efficiency in judicial procedures involving the service of process. Until this case, it had not been challenged on due process grounds.

It is well established that procedural due process requires that litigants must receive adequate notice, and an opportunity to be heard. However, it is also well established that potentially less effective methods of service may be employed where traditional or more efficient means of service have been attempted and were unsuccessful. Yet, the notice provided must be reasonably calculated, under all the circumstances, to afford the interested parties their proper notice.

Court’s Holding

The court held that Prime Realty, as an L.L.C. is required to file with the SDAT an accurate address for its principal office and resident agent. Further, if either of these addresses change, an L.L.C. is also required to file the appropriate change of address notification with the SDAT. The rule was drafted in a way that provides an additional method of service upon an L.L.C. that is not personal to them. Substituted service on the SDAT is permitted in three circumstances: where the entity has no resident agent; where the resident agent is dead or is no longer at the address for service of process maintained with the SDAT; or where two good-faith attempts of service on separate days failed. The court found that the plain language of the rule ensures that substituted service would provide the interested parties notice and an opportunity to be heard.

The court looked to two previously decided cases to help illustrate its ruling. In Biktasheva, the court held that because the process server determined the defendant’s resident agent was no longer located at the address on file with the SDAT, service upon the SDAT was proper. Biktasheva v. Red Square Sports, Inc., 366 F. Supp. 2d 289 (D. Md. 2005). Following the court also found that in Thomas, when a resident agent cannot be served to the address listed in the SDAT records, alternative service is deemed proper. Thomas v. Rowhouses, Inc., 206 Md. App. 72 (2012). The court found that legitimate efforts were made to notify the defendant of the action and that they were reasonably calculated to bring attention to Prime Realty. Specifically, the City attempted to serve Prime Realty’s resident agent at the address on file with the SDAT on July 20, 2018, and July 27, 2018, before they substituted service to the SDAT on September 5, 2018.

Prime Realty’s failure to accurately update its resident agent’s address with the SDAT does not invalidate the City’s attempts of service, and therefore does not constitute a due process violation. The court states that it was Prime Realty’s obligation to accurately record its agent’s address with the SDAT. It was also required that Prime Realty understand how to satisfy the address requirements. Lastly, the court held that the City’s knowledge of the address change does not correlate to the City having actual knowledge that the address they used was incorrect.

Notes and Comments

The court’s deference provided to the legislative history of Maryland Rule 3-124(o) may seem a bit drastic. However, the history of the current rule reflects both a policy decision of the General Assembly and a procedural decision of the judiciary to provide alternative methods of service on business entities.

The rules well-established history coupled with the statutory requirements expected of an L.L.C. demonstrate that substituted service upon the SDAT is a practical method of service that affords both litigants their due process rights. The rule strikes a balance between satisfying litigants due process rights and promoting efficiency in judicial proceedings.

Maryland Lawyer Blog

Maryland Lawyer Blog