I frequently get an email that is some version of this one on the diminished value of cars after a crash:

Hello Professor Miller,

It’s [name withheld], and I took Sports Law from you (really learned a lot by the way). Anyway, the reason, for my [voicemail], and why I’m writing is because I have a friend who has a problem. He purchased what I believed was an SUV, brand new in 2006. A few months ago it was stolen and vandalized. The police were eventually able to recover it, but it was totaled. According to my friend the blue book values the car at a certain amount, but the insurance company is not willing to pay him anything near the blue book value of the car. The more time passes the more the value decreases. My friend would like to recover the fair value of his vehicle and would like to know what his recovery rights are. I am sure you are incredibly busy, but my friend also wanted me to refer him to someone I trusted and was an expert in insurance law.

If time is an issue, do you perhaps have someone whom you might recommend?

My friend’s name is: [name and number withheld]

Thanks!

The reality is that most lawyers – including me – will not handle property damage or total loss diminished value cases. We do, however, offer on our Miller and Zois website tips for people handling property damage claims without a lawyer.

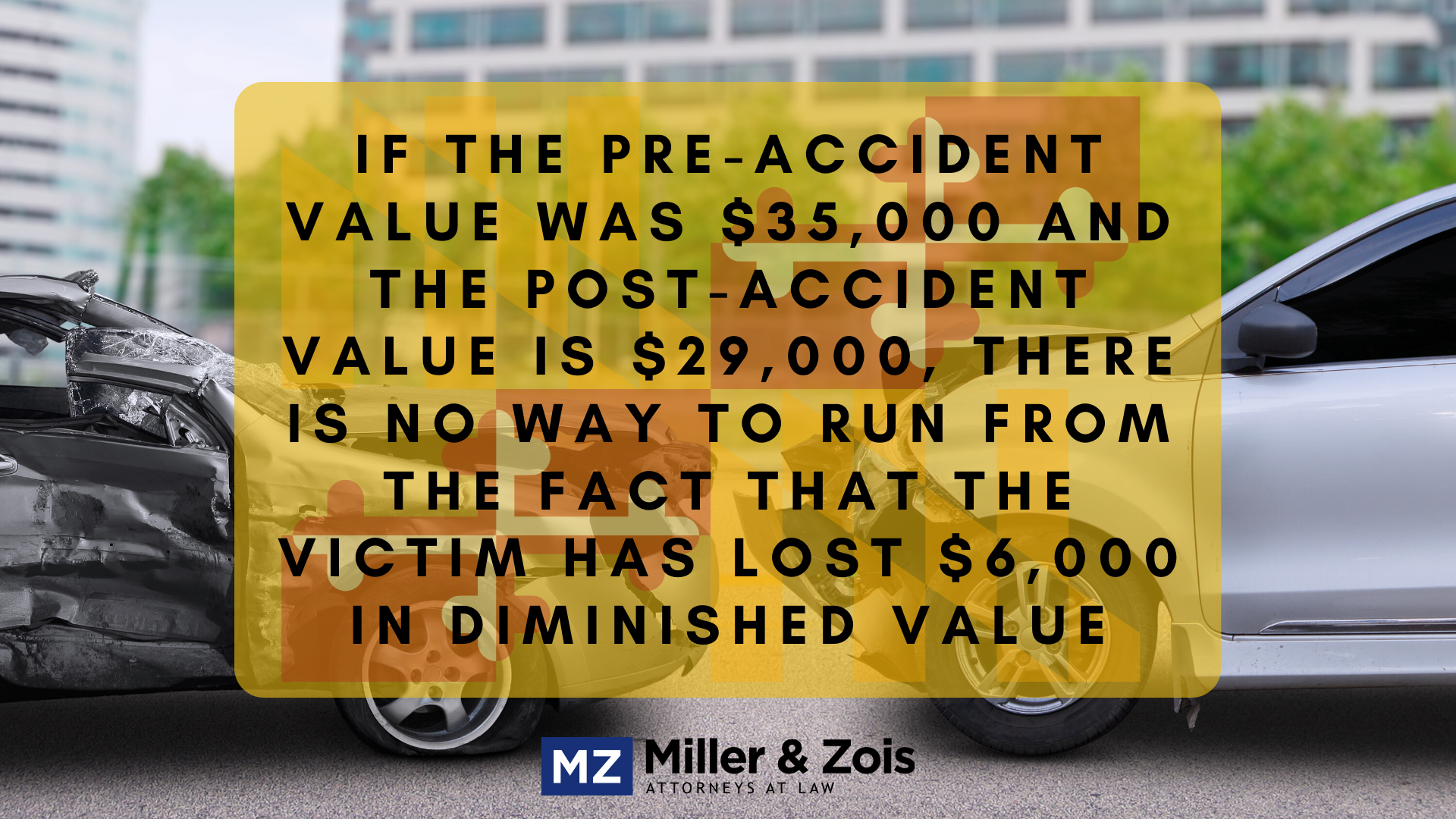

The nutshell with these cases is that the insurance companies pretend that repairing the car confines their exposure to the cost of those repairs and not the diminished value of the vehicle. But this is not true. The diminished value of your car is the difference between its pre-loss value and its new value after having been fully and properly repaired.

How Do You Get Kelley's Blue Book into Evidence at Trial?

Kelley’s Blue Book is hearsay. But Maryland Rule 803(b)(17) has an exception for “market quotations, tabulations, lists, directories, and other published compilations, generally used and reasonably relied upon by the public or by persons in particular occupations.” You may not need this rule if lawyers are not involved on both sides and the amount of damages sought is less than $5,000.

Diminished Value Case Law

- Delaware (bad) O’Brien v. Progressive Northern Ins. Co., 785 A.2d 281 (Del. 2001) (policy language does not cover loss from diminished value and that “the ‘repair or replace’ language crafted to limit the insurers’ liability is clear….”

- Texas (good): Noteboom v. Farmers Texas County Mut. Ins. Co., 406 S.W.3d 381 (Tex. App. Fort Worth 2013) (underscoring that vehicle damages and diminished value are different animals – diminished value is calculated based on a comparison of the original value of the property and the property’s post-repair value).

- South Carolina (bad): Schulmeyer v. State Farm, 579 S.E.2d 132, 135-36 (S.C. 2003), (no obligation to pay for diminution in value under the auto policy with the policy language that “expressly limits coverage to the lesser of the actual value or the cost of repair. These are alternatives, which do not include an additional obligation to pay for diminished value when the cost of repair is chosen.”

- Washington (good): Moeller v. Farmers Ins. Co. of Wash., 173 Wn.2d 264, 271, 267 P.3d 998 (2011) (The reasonable value of necessary repairs plus “the difference between the fair cash market value of the property immediately before the occurrence and its fair cash market value after it is repaired”). See also Pacheco v. Oregon Mutual, 447 P.3d 207 (Wash. Ct. App. 2019)(the diminished value of a vehicle is “property damage” as defined in the statute mandating underinsured motorist (UIM) coverage. Washington courts will ignore an express policy exclusion for coverage for the diminished value of the damaged vehicle because it conflicts with Washington law).

If you want a car accident lawyer in Maryland to help you sort through this, give us a call.

Maryland Lawyer Blog

Maryland Lawyer Blog